JD Beauty/Wet Brush is featured in a two page spread in the current issue of the Beauty Industry Report, a monthly newsletter for executives in the professional beauty business.

Author: admin

Topspin Partners Acquires a Majority Interest in Palmetto Moon

November 7, 2016. Topspin Partners today announced that it has acquired a majority interest in Palmetto Moon, a specialty retailer in the Lifestyle Merchandising segment in the southeastern U.S., from its owners and founders Bob and Karen Webster. Mr. and Mrs. Webster will be stepping back from their day-to-day roles within the company, but will continue to serve the company and provide strategic guidance in a consulting capacity.

“In choosing a financial partner, it was very important for us to maintain the collaborative culture that we have developed over the last 15 years, and Topspin will be able to bring an extensive network of industry executives and expertise in growing companies like ours,” Mr. and Mrs. Webster said. “This new partnership will allow Palmetto Moon to grow quickly and profitably in a number of new markets.”

Palmetto Moon’s management team will be led by CEO Eric Holzer, who took over the role in 2016 from Mr. Webster and has over 14 years of experience with Palmetto Moon, serving in nearly every area of the organization. Mr. Holzer stated, “Palmetto Moon has become a strong regional player in the specialty retail market over the last 15 years, growing to eleven stores across South Carolina, Georgia and North Carolina. I am excited about partnering with Topspin to continue growing Palmetto Moon’s footprint.”

“We are very impressed with the business the Websters have built and the growth that the company has achieved to date, and we see great potential for continued expansion within the southeast and beyond,” said Steve Lebowitz, Managing Partner at Topspin. “We are excited to partner with Eric and the company’s management team to capitalize on that potential and accelerate the company’s growth.”

Motivity Capital Partners, a private equity firm with extensive experience in retail and operations invested alongside Topspin Partners. “We are excited to team up with Topspin and the management team at Palmetto Moon. The company’s dynamic merchandising concept led by their strong management team has produced outstanding results and we look forward to working with them to grow the business,” said Jack Gunion, Partner at Motivity.

Additional information about Palmetto Moon can be found at http://palmettomoononline.com/.

About Topspin

Topspin Partners is a suburban NY-based private equity fund that makes control investments in profitable and established lower middle-market businesses. The firm invests across a number of industries, including niche consumer, health and wellness, food and beverage, business services and security. The Topspin team has considerable operational expertise and collaborates with management teams to build businesses of varying stages and sizes. Further information on Topspin can be found at www.topspinpartners.com.

Media Contact

Burke Hall

Topspin Partners

914-834-7370

PlayMonster™ Acquires Award-Winning Wood Vehicle Line, Automoblox®

Continues Strategic Expansion with Third Acquisition in Less Than Two Years

September 7, 2016 — BELOIT, Wis. – PlayMonster LLC (formerly Patch Products), announces its third acquisition in less than two years with the closing of Automoblox®, an award-winning line of high-quality, collectible toy vehicles that innovate the classic wooden toy car category. Automoblox puts kids and adults in the driver’s seat with collectable build-and-mix interchangeable parts that reinvent play.

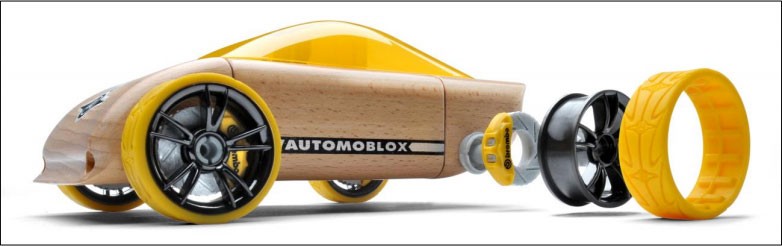

Automoblox 2016 C9 Sportscar

“With Automoblox, we’ll continue building on their vision to innovate the vehicle category, and empower fans to mix-and-match their way to customization,” said Bob Wann, Chief PlayMonster of PlayMonster LLC. “From cool sedans and rugged trucks, to sporty vans, sleek sports cars, and just about the coolest police car I’ve seen, we love their impressive designs, high-quality materials and creative building features. We’ve had our eye on Automoblox for some time, and are excited to add their range to PlayMonster’s growing multi-brand portfolio of innovative toys and games.”

Each Automoblox vehicle sports a body made of European beech wood, and includes multiple interchangeable components, including tires, rotors and calipers. It’s easy enough for kids as young as 3 to get in on the fun, and the cool, collectible, and mix-and-match designs appeal to older kids and adults as well.

Automoblox has received attention from the media in publications such as Motor Trend, Newsweek, Parents Magazine and Car and Driver. Automoblox also received the prestigious Oppenheim Platinum Toy Award for its line of emergency vehicles.

PlayMonster plans to continue to grow the Automoblox brand and make it more widely available both at retail and online.

About PlayMonster LLC

PlayMonster is a diversified toy and game company based in Beloit, Wisconsin, committed to delivering great play value, with a powerful portfolio that keeps play alive for of all ages from infants through adults. They design, manufacture and market quality products like the awardwinning The Game of THINGS…®, 5 Second Rule®, Mirari®, Perplexus®, Stinky Pig™, Yeti in my Spaghetti®, Farkle, Chrono Bomb®, OK to Wake!®, Lauri®, Stratego®, Roominate®, My Fairy Garden™ and Wooly Willy®.

Contact

Lisa Wuennemann

PlayMonster LLC

(800) 524-4263, ext. 275

lisaw@playmonster.com

Genna Rosenberg

GennComm for PlayMonster LLC

(818) 839-1461

Genna@GennComm.com

Topspin Partners Acquires a Majority Interest in Texas Family Fitness

August 15, 2016. Topspin Partners today announced that it has acquired a majority interest in Texas Family Fitness (TFF), an operator of high amenity, high value health and fitness clubs in the suburban Dallas, TX area, from its owner and founder Trevor Rogers. Mr. Rogers retains a significant ownership stake in the company, and will remain on the board of directors of the company to provide strategic guidance on the company’s expansion strategy.

“I was looking for the right partner to help accelerate the growth of the business, and due to their knowledge and experience in the fitness industry, Topspin represents exactly that,” Mr. Rogers said. “Topspin’s expertise and network will be a tremendous asset for TFF going forward as the company expands.”

TFF’s management team will be led by new CEO Aaron Watkins, who brings years of experience in the fitness industry and a deep understanding of the Dallas-Fort Worth fitness and real estate markets. Mr. Watkins previously served as President of Gold’s Gym International, Inc. Mr. Watkins stated, “TFF is uniquely positioned in the Dallas market, offering its members high-value, full-service fitness clubs at an attractive price. I am excited about partnering with Topspin and Trevor to continue expanding TFF’s footprint.”

“We are impressed with the business and brand that Trevor has built and see great potential for expansion within the Dallas-Fort Worth market and beyond,” said Leigh Randall, Managing Partner at Topspin. “We look forward to working with Aaron and the company’s management team to achieve those opportunities and accelerate the company’s growth.”

Integrity Square advised TFF’s owner, Mr. Rogers, in this transaction. This new partnership between Trevor and Topspin is the product of the longstanding relationship between Topspin and Integrity Square. In addition, the relationship with Mr. Watkins was fostered from Integrity Square’s work with him on several health club acquisitions since 2010.

Additional information about TFF can be found at www.texasfamilyfitness.com.

About Topspin

Topspin Partners is a suburban NY-based private equity fund that makes control investments in profitable and established lower middle-market businesses. The firm invests across a number of industries, including health and wellness, niche consumer, food and beverage, business services and security. The Topspin team has considerable operational expertise and collaborates with management teams to build businesses of varying stages and sizes. Further information on Topspin can be found at www.topspinpartners.com.

About Integrity Square

Integrity Square, founded in 2010 with offices in New York City and Boca Raton, Florida, is the leading financial and strategic advisory firm focused on the Health, Active Lifestyle and Outdoors (“HALO”) sector. For further information, please visit www.integritysq.com.

Media Contact

Burke Hall

Topspin Partners

914-834-7370

Topspin Partners Exits Stagnito Business Information

February 18, 2016. Topspin Partners (“Topspin”), a Mamaroneck, NY-based private equity firm focused on the lower-middle market, has exited its portfolio company Stagnito Business Information (“Stagnito”), a leading business information services company providing the grocery and convenience store industries with leading print, digital, research and event offerings.

As a part of Topspin’s exit strategy, Stagnito has merged with Edgell Communications (“Edgell”), which will allow Stagnito and Edgell to develop more powerful products and services for its audience and customers. The acquirer of the newly merged company, private equity investor RFE Equity Partners, will help continue to grow the company through future acquisitions as well as organic growth.

Topspin Managing Partner Steve Lebowitz was pleased with the transaction, stating, “We are glad to have achieved another very successful exit for our investors. We are proud to have had a role in supporting Stagnito’s growth over the last four years and have enjoyed working with the management team and employees at the company.”

Kollin Stagnito, who will be going forward as Stagnito’s Chief Executive Officer, stated, “Topspin has been an exceptional partner for Stagnito over the last four years. Through providing strategic guidance, financing support, and assistance in finding acquisition targets, Topspin has enabled our company to grow and mature and continue to provide exceptional service to our customers.”

Stagnito Business Information is a business-to-business information, media, and marketing resource serving retailers and their supplier/distributor partners in the North American grocery, and convenience store markets. The Company’s brands include Convenience Store News (CSN), CSNews for the Store Single Operator (SSO), Private Label Store Brands (PLSB), Retail Leader, Progressive Grocer and Multicultural Retail (MR 360). Stagnito offers a variety of print, digital, event, market research and custom media offerings, all serving the grocery and convenience store industries. www.stagnitomedia.com

Topspin Partners is a suburban NY-based private equity fund that makes control investments in profitable and established lower middle-market businesses. The firm invests across a number of industries, including health and wellness, niche consumer, food and beverage, and information services. The Topspin team has considerable operational expertise and collaborates with management teams to build businesses of varying stages and sizes. Further information on Topspin can be found at www.topspinpartners.com.

Media Contact Information

Burke Hall

Topspin Partners

914-834-7370

Patch Acquires Award-Winning STEM Product with Roominate

January 15, 2016. BELOIT, Wis.— Patch expands from puzzles, toys and games into a new category of STEM with the acquisition of Roominate™. STEM (Science, Technology, Engineering and Math) has become a prominent topic within the toy industry, as it builds important education through play with the children of today who could be the scientists and engineers of tomorrow.

Roominate is an award-winning line of complete building sets that are designed for girls in order to bridge the gender gap in STEM. The line was started with one simple mission: open up possibilities for girls by showing them that creativity and engineering are fun. The success through the implementation of this mission has led Roominate to win many awards, including Forbes “Top 10 Toys to Watch in 2015,” TIME “Toy of the Year,” 2015 TOTY Finalist and many more.

Roominate currently consists of 12 sets, some for 6 years and up, and others for 8 years and up. Children can build interactive sets like a school bus, amusement park and many more that come to life through the use of things like motors and lights. The interactive app also allows “Roominaters” to remotely control motors and lights, and get design ideas from fellow “Roominaters.” In short, Roominate lets girls build the world they want to play in.

Alice Brooks, co-founder of Roominate, is very pleased to join Patch: “Patch’s entrepreneurial spirit and innovative culture is exactly what we were looking for to help grow Roominate. We’re happy about this significant development and look forward to working with the Patch team to continue to inspire the next generation of innovators.”

Girls need more encouragement when it comes to excelling in the sciences. Boys are three times more likely to be interested in science, technology, engineering and math (STEM), and six times more likely to obtain a job in engineering. Roominate aims to change that, and the acquisition by Patch will help take the line to the next level. Because Patch values their expertise, the Roominate founders will remain involved and play a vital role in the future of the brand.

“We are excited and honored to take on a concept that gets girls excited about engineering through play,” said Bob Wann, CEO of Patch Products. “It’s also an important move for Patch because Roominate continues the diversification of our line of products: from the best-selling Mirari® infant toys, to the educational Lauri® brand, to award-winning Patch adult games, and now innovative Roominate girls’ toys.”

Stephen Lebowitz, Managing Partner at Topspin Partners, owners of Patch Products, commented, “The acquisition of Roominate is part of the strategy to build on Patch’s foundation, continuing its momentum of becoming a major toy company with quality brands in diverse categories for consumers of all ages.”

Patch Products, LLC is a leading designer, manufacturer and marketer of games, children’s puzzles, infant/toddler toys, creative activities and teaching tools, with focus on innovation and growth of brands and categories. Top-selling brands include 5 Second Rule®, Perplexus®, Don’t Rock the Boat™, Farkle, The Game of THINGS…®, Chrono Bomb®, OK to Wake!®, Mirari®, Buzzword®, Stratego®, Lauri® and Wooly Willy®.

Contact

Sally May Baker

Patch Products, LLC

(800) 524-4263, ext. 241

sallyb@patchproducts.com

Topspin Partners Acquires Polder Housewares

January 12, 2016. Topspin Partners today announced that it has acquired Polder Housewares (“Polder” or the “Company”), a leading designer, marketer and distributor of branded, innovative housewares products in the kitchen storage and prep, home organization, and laundry categories.

Polder’s management team will remain with the Company, led by CEO Calvin Scott, who brings over 30 years of experience and longstanding relationships in the housewares industry. Mr. Scott stated, “Polder has experienced 10 years of uninterrupted growth, and we were looking for a strategic partner to help us continue to grow and take the Company to the next level. We believe that, with Topspin’s expertise in helping to foster the growth of niche consumer brands, Topspin is just that partner for Polder and we are very excited about our future.”

“We are impressed with the growth that Polder has achieved to date, as well as its track record of developing innovative housewares products,” said Stephen Lebowitz, Managing Partner at Topspin. “We look forward to partnering with and supporting the management team as they continue to scale the business and grow the Company’s brand, and plan to actively seek acquisition opportunities to accelerate the Company’s growth.”

Additional information about Polder can be found at www.polder.com.

About Topspin

Topspin Partners is a suburban NY-based private equity fund that makes control investments in profitable and established lower middle-market businesses. The firm invests across a number of industries, including health and wellness, niche consumer, food and beverage, business services and security. The Topspin team has considerable operational expertise and collaborates with management teams to build businesses of varying stages and sizes. Further information on Topspin can be found at www.topspinpartners.com.

Media Contact

Burke Hall

Topspin Partners

914-834-7370

Topspin Partners Acquires a Majority Interest in JD Beauty

October 21, 2015. Topspin Partners today announced that it has acquired a majority interest in JD Beauty (“JD” or the “Company”), a leading designer and marketer of branded, professional-quality hair brushes and beauty care accessories. The Company’s flagship detangling brush, the Wet Brush, is the number one hair brush brand in the professional channel and the fastest-growing hair brush brand in the consumer retail channel. JD was advised in the transaction by Intrepid Investment Bankers.

With nearly 40 years of experience in the hair care category, Mr. Jeff Rosenzweig, founder and CEO of JD Beauty, will continue to lead a highly respected management team with longstanding relationships in the industry. Mr. Rosenzweig stated, “We are excited to have Topspin as our partner going forward. Their expertise and network in the personal care industry will be invaluable as we further grow our brand and expand our market presence. Topspin’s strategic insight will be helpful as we consider various avenues for growth.”

“The Wet Brush reinvigorated the hair brush category with design and function and redefined the ‘detangling brush’” said Leigh Randall, Managing Director at Topspin. “The Company has established tremendous consumer and stylist acceptance and a loyal and growing base of consumers as evidenced by its rapid growth over the last few years. We are looking forward to supporting the management team as it builds upon the Company’s strong foundation and expands the Wet Brush brand into complementary new channels.”

Additional information about JD Beauty can be found at www.jdbeauty.com.

About Topspin

Topspin Partners is a suburban NY-based private equity fund that makes control investments in profitable and established lower middle-market businesses. The firm invests across a number of industries, including health and wellness, niche consumer, food and beverage, business services and security. The Topspin team has considerable operational expertise and collaborates with management teams to build businesses of varying stages and sizes. Further information on Topspin can be found at www.topspinpartners.com.

Media Contact

Burke Hall

Topspin Partners

914-834-7370

Topspin Partners LBO Acquires HCOA Fitness

January 8, 2014. Roslyn Heights, NY – Topspin Partners LBO (“Topspin”) today announced that it has acquired HCOA Fitness (“HCOA”), the largest operator of fitness clubs and personal training services in Puerto Rico. HCOA is headquartered in Miami, FL.

“After evaluating many health and wellness opportunities in recent years, we are excited to have found this outstanding company,” said Topspin Managing Director Leigh Randall. “HCOA’s management team and employees have impressed us since our early conversations, and we look forward to supporting them as the company continues to build upon its strong foundation as the leading fitness company in Puerto Rico.”

Juan Ortega, CEO of HCOA, commented on the transaction, “Topspin’s acquisition of HCOA is very exciting for our team as it affords us a unique opportunity to further grow our brand and expand our market presence. Topspin’s strategic insight will play a key role in our quest to redefine fitness within the modern health club.”

The sellers will remain significant equity holders and active partners in the business. Johnathan Robertson, President and Managing Director of TG Capital Corp expanded, “We have enjoyed our association with HCOA over the past four years and are thrilled to partner with Topspin to support HCOA’s future growth.”

Topspin completed the acquisition with debt financing from Brookside Mezzanine Partners, which provides subordinated and unitranche loans to mall- and mid-sized companies. Brookside also invested alongside Topspin’s equity in the transaction.

Additional information about HCOA can be found at www.hcoafitness.com.

Topspin Partners LBO is a Long Island, NY-based private equity fund that makes control investments in profitable and established lower middle-market businesses. The firm invests across a number of industries, including consumer products and services, business and information services, health and wellness, food and beverage, retail, and security. The Topspin team has considerable operational expertise and collaborates with management teams to build businesses of varying stages and sizes. Further information on Topspin can be found at www.topspinlbo.com.

TG Capital Corp invests in established companies with strong market positions across a broad spectrum of industries. Generally, TG Capital Corp focuses on companies at a pivotal point in their development when they are in need of either capital or management and provides either or both, as needed, to enable these companies to realize their full potential.

Media Contact Information

Grace Cipriano

Topspin Partners LBO

516-625-9400

Topspin Partners LBO Exits Hart Systems

December 19, 2013. Topspin Partners LBO (“Topspin”), a Long Island, NY-based private equity firm focused on the lowermiddle market, has exited its portfolio company Hart Systems, LLC (“Hart”), the leading global provider of self-managed inventory counting services to retailers.

The acquirer, Zebra Technologies (“Zebra”), is a global leader in barcode printing and RTLS technology including printers, RFID, software and supplies. Its acquisition of Hart not only provides Zebra a strong position in the market, but also affords Hart the continued support to execute on its growth strategy.

Topspin Managing Director Steve Lebowitz was pleased with the transaction, stating, “We are glad to have achieved another highly successful exit for our investors. Hart is a special company with a group of exceptionally-talented employees, and we are honored to have played a role in its remarkable growth story.”

Hart Chief Executive Officer Ed Tonkon stated, “Over the past five years, Topspin has been a true partner in the creation of value for our employees, customers and stakeholders. Not only did the Topspin team provide financial capital, but it also gave the strategic guidance that has enabled our company to develop a highly successful business model, providing exceptional value to our customers.”

Hart Systems, LLC, founded in 1964 and based in Long Island, NY, is the leading global provider of selfmanaged inventory counting services to retailers. Hart’s proprietary, cloud-based solutions enable retailers to conduct physical inventory in their stores using their own employees and the company’s solutions are deployed to clients in over 35 countries across a broad range of retail segments, including apparel, grocery, consumer electronics, convenience, automotive and housewares. Hart has distinguished itself by offering its customers high return-on-investment, best-in-class self-managed inventory solutions that have disrupted the traditional approach of outsourcing to third parties. www.hartsystems.com

Topspin Partners LBO is a Long Island, NY-based private equity fund that makes control investments in profitable and established lower middle-market businesses. The firm invests across a number of industries, including consumer products, consumer services, business services, food/beverage, retail, information services and security. In addition, the Topspin team has considerable operational expertise and collaborates with management teams to build businesses of varying stages and sizes. Further information on Topspin can be found at www.topspinlbo.com.

Stifel, Nicolaus & Company, a St. Louis, MO-based full service brokerage and investment banking firm, served as advisor to Topspin.

Media Contact Information

Grace Cipriano

Topspin Partners LBO

516-625-9400